January 5, 2016

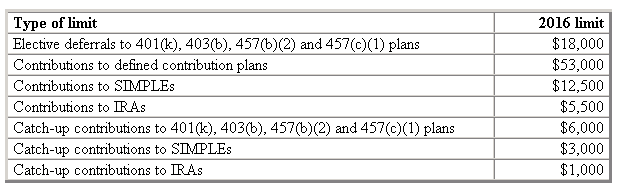

Retirement plan contribution limits are indexed for inflation, but with inflation remaining low, the limits remain unchanged for 2016:

Nevertheless, if you’re not already maxing out your contributions, you still have an opportunity to save more in 2016. And if you turn age 50 in 2016, you can begin to take advantage of catch-up contributions.

However, keep in mind that additional factors may affect how much you’re allowed to contribute (or how much your employer can contribute on your behalf). For example, income-based limits may reduce or eliminate your ability to make Roth IRA contributions or to make deductible traditional IRA contributions. If you have questions about how much you can contribute to tax-advantaged retirement plans in 2016, check with us.

© 2016 Thomson Reuters/Tax & Accounting

Pingback: Why It’s Time to Start Tax Planning for 2016 | Boris Benic CPA

Pingback: Last Chance to Set Up Your 2016 Retirement Plan | Boris Benic CPA